** Note ** Subsequent to the publication of this article, it was announced that the underlying index would be expanded to over 100 holdings from the 30 as originally reviewed (and noted as a risk) below. This amendment should broaden the investment universe for the ETF with the result being that it should be less volatile moving forward. We do not (yet) know which holdings will be added.

More info: Here

——

One of the most popular ETFs of 2020, this ‘Thematic’ ETF from the iShares/Blackrock stable focuses on the trendy Clean Energy sector with investments in 30 listed global companies.

The benchmark for this fund is the S&P Global Clean Energy Index, and the underlying currency is the US Dollar - in line with the majority of global equity ETFs - so there is a need to be conscious of currency risk here (a declining pound vs. dollar will be positive for sterling holders; the reverse will be a headwind).

With 10 constituents hailing from Europe, the fund has around a third exposure to the ‘Old World’, with a further 9 companies (30%) coming from the USA. The remainder of firms are based in China (3), Canada, Brazil, New Zealand (2 each) and Israel & South Korea with one apiece - so this is fairly diversified from a country of origin perspective.

A point to note here: Thirty companies from around the globe isn’t an awfully large number of companies to include within an Index, so why so few?

Well, the underlying index is provided by S&P Global, and their methodology states:

Which doesn’t help us much, apart from noting there is a relatively low $300m market cap minimum.

So why are companies such as General Electric, who are heavily involved in making/installing wind turbines (amongst, admittedly many other lines of business) excluded?

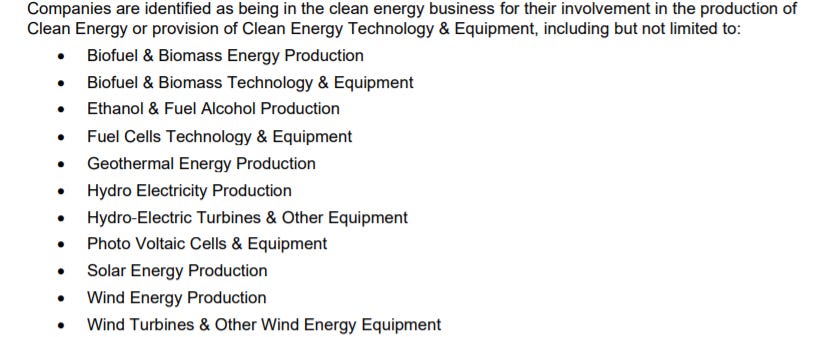

The answer seems to be that the criteria for the definition of the company is relatively strict, so that only ‘pure’ focused companies in the following sectors are included:

So there are financial considerations (market size etc), ‘purity’ of company in relation to the above sectors and finally there is a score based on Carbon Footprint per Revenue. You have to be a very focused company in the above sectors to qualify, and it’s interesting that a company like Tesla isn’t included, given that aside from cars, they also sell battery energy storage, solar PV equipment etc.

The current breakdown of the companies, and the percentage of the fund allocated to each are as below:

(Note - this is based on weightings as of 19th February and subject to change)

Overall, a fairly evenly distributed weighting per company, with some recent solar stock market darlings such as Enphase Energy (ENPH) having a meaty slice of the ETF pie - although this may be due to their stellar stock performance this past twelve months and may fall in any future rebalancings.

It is worth checking through the holdings to get a feel for the companies involved, their size and their prospects.

One glaring outlier is that of ‘Plug Power’, who occupy just over 9% of the ETF portfolio. This has actually fallen from 10.7% in the past week as the share price of Plug Power (PLUG) has fallen by 22%.

Whilst I am by no means an equities analyst, it is worth running some simple valuation metrics across Plug, as an example of a high growth business in this sector.

Firstly, the current (as of 19th February 2021) market capitalisation is $29.8bn. The company is unprofitable (as are many growth companies) but in Q3 2020 actually lost money at the gross profit level, which is rarely a good start, although this may be just a rogue quarter.

So let’s say that the company will grow and that they will be come profitable in the future, and that you would be willing to pay fifty times earnings for the company (for reference Google currently trades around 35 times earnings). Let’s also say that they’ll manage to obtain a 10% operating profit margin (which seems fair for a manufacturing/fuels business).

To get to a level of fifty times earnings at today’s share price, revenues would need to hit around $6bn per annum compared to their current trailing twelve month revenues of $308m. To get to the target, revenues would need to grow by somewhere in the region of 60%, per year, for around five years. Thats software company levels of growth, without the accompanying boost of high gross margins.

Now, maybe Plug do turn out to be the new Apple of the hydrogen world, but its certainly worth bearing in mind that this ETF has just under 10% of its fund dedicated to such a richly valued stock. (Note, the high weighting will most likely be down to the huge growth in Plug’s share price over the past year, so future rebalancing may take this down).

A few further important points to note here.

Firstly, the clean energy sector is a ‘growth’ industry, and as with many similar industries, it contains a large portion of highly valued companies which may be currently unprofitable, and in the future non-existent. Investors need to bear this in mind as with only 30 odd companies in the index, a dramatic drop in share price of a few of them (or even bankrupty) will have a knock on effect on the total asset value of the fund, and thus the share price.

Secondly, growth companies are also subject to large swings in valuation when interest rates change (in the same way that long term bonds are also affected).

Thirdly, some of the technologies these companies are investing in may turn out to be the Betamax of the future energy world, which will damage the performance of this fund (although you would hope future sectors will emerge and be added to the index).

Taking a quick look at the growth of this fund and you can see how spectacular the inflows have been from global investors looking to capitalise on the Clean Energy ‘Revolution’:

The net assets of the fund have increased from around $2bn during the March ‘Covid Crash’ to just under $6.5bn as of this week - an increase of $4.5bn - which is an astonishing gain and either shows speculative excess, or a firm flow of confident capital to power future energy infrastructure. There is an interesting chicken-and-egg question here - are flows from ETFs such as this powering the share price rises of the constitents, which brings more investors on board in a ‘rising tide lifts all boats’ scenario?

For income enthusiasts, this fund does offer distributions - paid bi-annually, usually around May & November each year - with the approx. yield at time of writing around 0.45% as per the official iShares site, although this was in the range of 2.5%-3% from around 2015 to the end of 2018, although the components would have been different from the current crop, and potentially more income focused.

Rounding up, its worth noting that this fund is ‘Physical’, in that it purchases (or sells) the underlying company shares in line with the underlying index, and that it contains an expense ratio of 0.65%, which feels high for an ETF which purchases fairly liquid securities, but there are fees to S&P for index use, plus some international shares which will come with higher trading charges than those on the US or major European exchanges. These fees will eat into your returns more than general equity index ETFs which charge somewhere in the region of 0.05-0.20%.

Quite a bit to take in here, but it is certainly worth reviewing the above if you approach this from the point of view of an investor looking to make long term returns.

Certainly, whilst I am personally a keen advocate of combatting climate change, investors will need to be conscious of the currency, valuation, concentration and interest rate risks highlighted above when doing their own research into whether or not to invest.

—-

As ever, the above should not be construed as investment advice, and investors should conduct their own due diligence before purchasing.

In addition, whilst every attempt is made to ensure accurate and up to date information, fund information is liable to change and updates may not be reflected in existing articles.

If you would like to help support this service, you are welcome to sign up to either the Trading212 or Freetrade share trading apps - we’ll both receive a free share of up to £100 in value (but probably less!).

http://www.trading212.com/invite/FMcKXOcc

https://magic.freetrade.io/join/christopher/4390be64